SME Financial Empowerment: An Imperative for Business Resilience

Small and medium-sized enterprises (SMEs) are the backbone of the Ghanaian economy, accounting for over 90% of businesses in the country. However, SMEs are also disproportionately affected by financial shocks, such as economic recessions and natural disasters. This is why financial empowerment is essential for SME resilience.

Financial empowerment refers to the ability of SMEs to access and manage financial resources effectively. This includes having access to affordable credit, financial planning skills, and knowledge of financial products and services. When SMEs are financially empowered, they are better able to weather financial storms and seize opportunities for growth.

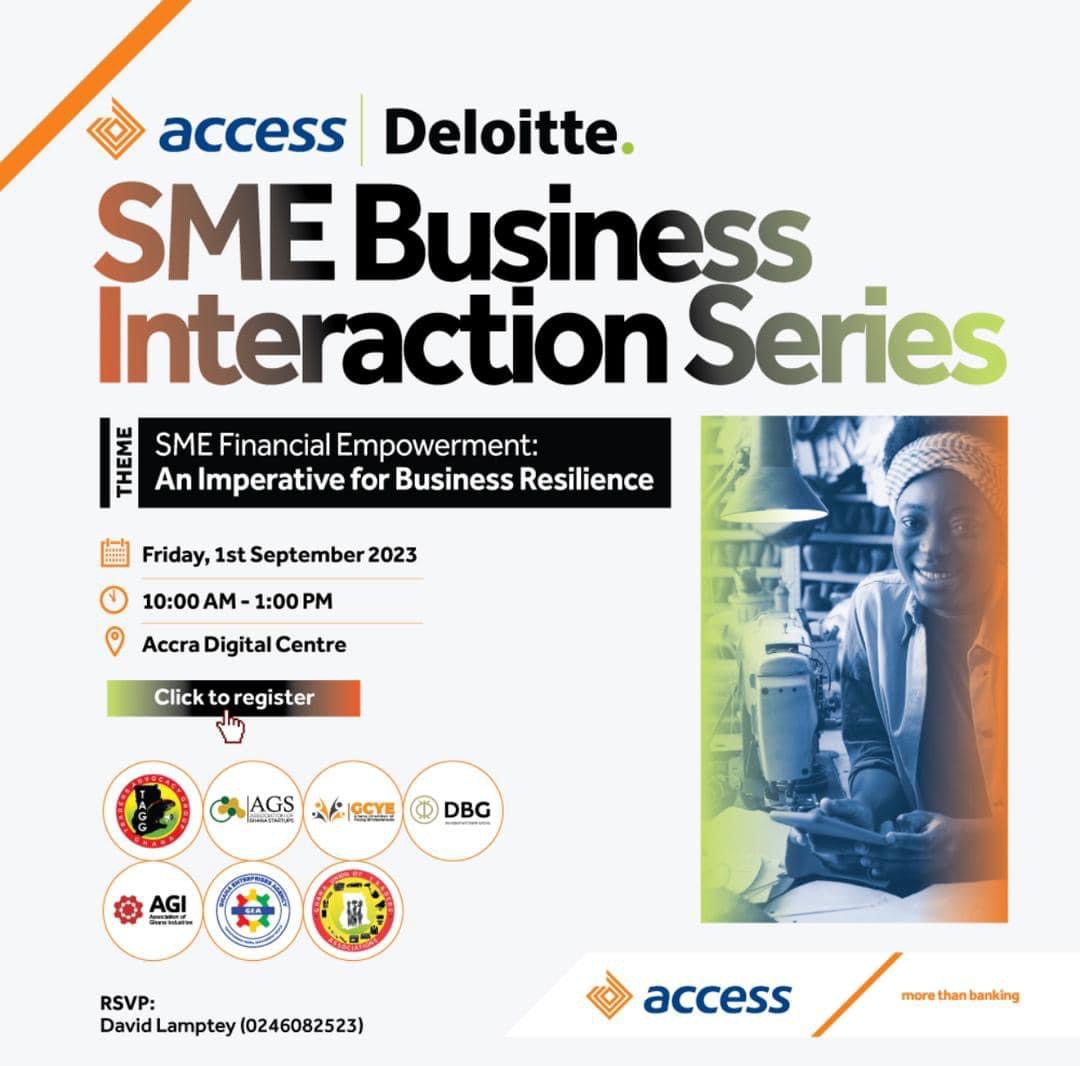

The Access Bank – Deloitte Ghana SME Business Interaction Series is a forum that brings together SMEs, financial institutions, and other stakeholders to discuss issues related to SME financial empowerment. The upcoming event on September 1st will focus on the topic of “SME Financial Empowerment: An Imperative for Business Resilience.”

The event will feature a panel of experts who will discuss the challenges and opportunities facing SMEs in Ghana, and how financial empowerment can help businesses become more resilient. The panel will also provide practical tips for SMEs on how to improve their financial management skills.

If you are an SME owner or operator, or if you are interested in learning more about SME financial empowerment, I encourage you to attend this event. It is a valuable opportunity to learn from experts and network with other business owners.

Here are some of the key benefits of SME financial empowerment:

- Increased access to credit: Financially empowered SMEs are more likely to be able to obtain the credit they need to finance their operations and grow their businesses.

- Improved financial management: Financially empowered SMEs are better able to manage their cash flow, track their expenses, and plan for the future.

- Reduced financial risk: Financially empowered SMEs are better able to manage financial risks, such as unexpected expenses or economic downturns.

- Increased business resilience: Financially empowered SMEs are better able to weather financial storms and bounce back from setbacks.

If you are an SME owner or operator, there are a number of things you can do to improve your financial empowerment. These include:

- Get financial advice from a qualified professional.

- Learn about financial products and services that are available to SMEs.

- Develop a financial plan for your business.

- Track your cash flow and expenses.

- Build up your savings.

Financial empowerment is an essential ingredient for SME success. By taking steps to improve your financial empowerment, you can help your business become more resilient and thrive in the long run.

I hope this article has been informative. If you have any questions, please feel free to ask.

Attend in person: https://rb.gy/mqdaw

🌐 Participate virtually: : https://us06web.zoom.us/webinar/register/WN_-s4c6_LvSUO1GBoE1RM2Fw

I will also be attending the event on September 1st, so I look forward to seeing you there!